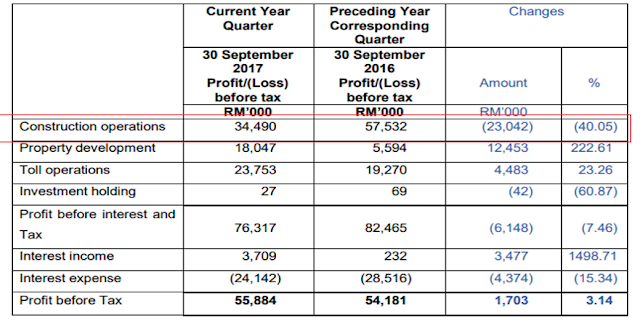

营业额增长8%, 净利起 34% 。整体看上去是蛮不错的成绩。 但是基于EKOVEST有三个不同的业务,让我们来一起看看

在三个业务当中,(1)建筑 (2)产业 (3)大道

产业方面取得了最大的成长,主要是因为产业方面销售提高了,然后该产业项目的建筑阶段也进展到不错,从而贡献进公司的营业额和盈利。

建筑方面营业额和盈利都下滑,主要是因为DUKE 2 在完成后,大道的建筑只剩下 SPE HIGHWAY 在建着。

大道方面主要是收取过路费 (TOLL FEES), 营业额和盈利在这个季度下跌的主要原因是因为去年的同个季度有一个一次性,大概RM8 MILLION 的赔偿。排除这个后大道方面的成长高达20%左右。 成长的主要来源也是因为更多车辆行驶以及去年 10月尾DUKE 2 完全通车了。

前景

产业方面的贡献接下来将持续稳定,公司有未入账销售大约450 million。 主要来自EKOCHERAS 和 EKOTITIWANGSA

建筑方面也是会稳定,目前在建筑的SPE HIGHWAY 大约在2020完工,GDV 大约 RM3.7 billion。建筑方面目前的订单足够支撑公司大约3 - 5 年。

大道业务方面我相信也会持续成长, DUKE 2 在去年10 月尾全面运行。公司也有很大机会在今年正式签署 DUKE 2A 的BINDING AGREEMENT.

风险

产业销售缓慢,未入账销售也跟着减少导致公司盈利下跌

建筑 (1)工程拖延,(2)如果DUKE2A签署后需要一笔庞大的资金,会加重公司的负债率。

大道的通车率下跌,无法符合预期的通车量。

总结

建筑是EKOVEST最大的贡献领域,在这个季度营业额和盈利的滑落下还好产业方面的贡献比例提高了导致这个季度的成长。接下来的整体成绩应该会持续上涨。